Market Review

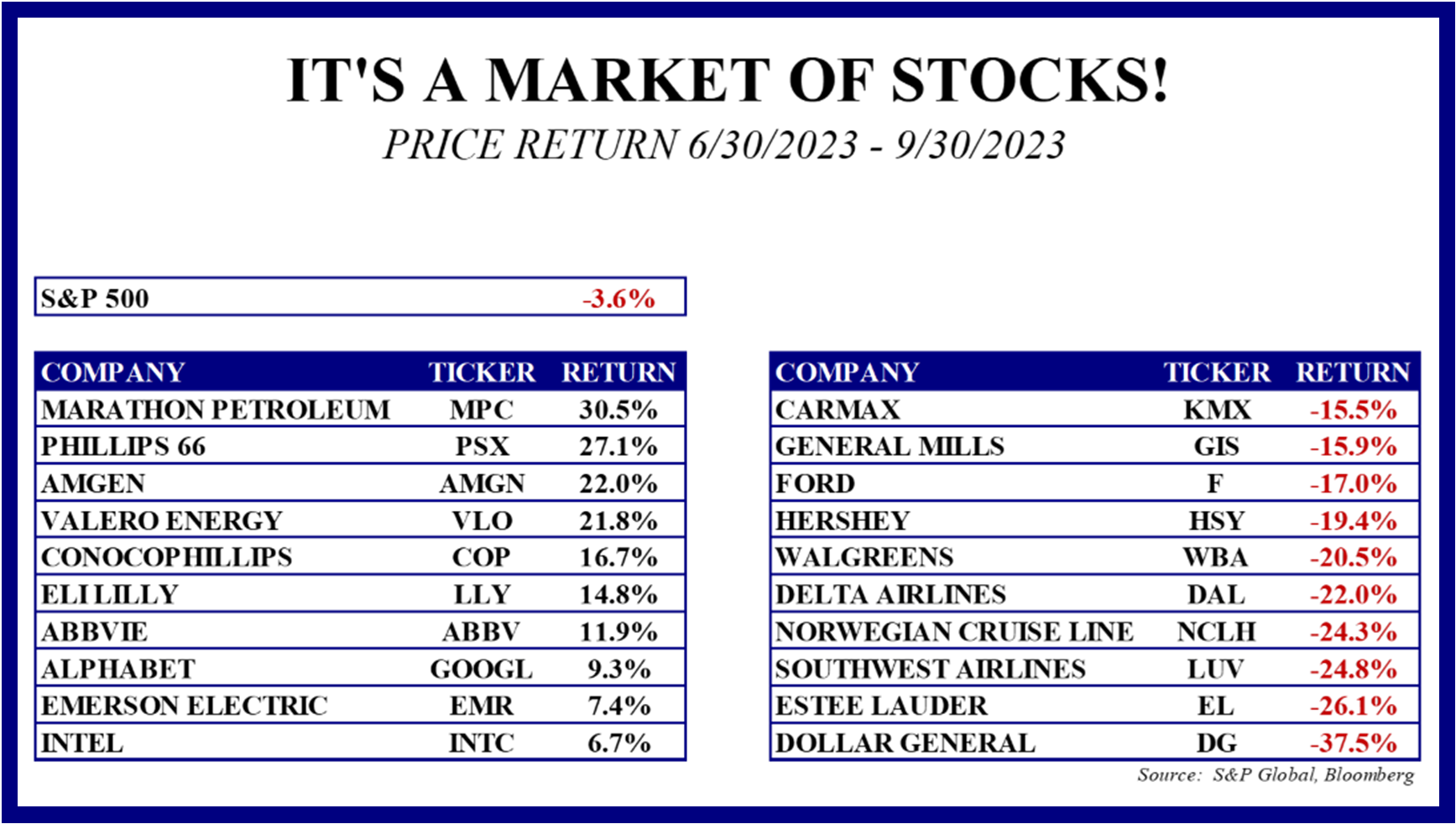

The benchmark S&P 500 index closed the 3rd quarter down 3.6% after a late September swoon. Commentators often use that benchmark to demonstrate the performance of “the stock market”, but as the graphic below illustrates, investors shouldn’t lose sight of the fact they can choose among “a market of stocks”. The Federal Reserve bumped their policy rate 0.25% higher in July before leaving that rate unchanged in September. S&P 500 earnings topped forecasts by 7.7% but still dropped 5.8% year-over-year. Revenues were 2.0% higher than expected, rising 0.9%. Interest rates trended higher across all maturities before spiking higher in late September, with a more pronounced movement in longer maturities, as bond markets priced in stubbornly resilient economic growth On the positive side, investors have an opportunity to purchase some of the highest yields available since before the Great Financial Crisis.

The Economy

The U.S. economy grew 2.1% during the 2nd quarter, over twice the consensus projection. Per the Federal Reserve Bank of Atlanta’s GDPNow model estimate, 3rd quarter growth is tracking just below 5%, which would mark the fastest quarter of growth since the 4th quarter of 2021. The consensus estimate points to growth slightly under 3%. Inflation as measured by the Federal Reserve’s favored Core Personal Consumption Expenditures Deflator continues to moderate versus year-ago levels, but remains above the desired 2% target. The labor market continues to post robust hiring gains, though the recent more modest figures may indicate less inflationary pressure going forward from the services portion of the economy. Oil prices rose sharply during the quarter, as the OPEC+ group including Russia continues to hold production levels down. Higher gasoline prices could weigh on consumer spending that has to-date remained sturdy, though energy and energy services comprise only 4% of U.S. consumers’ wallet share versus 10% during the 1970s oil embargos.

Equity Markets

From a sector perspective, the 3rd quarter was a tale of the “haves” and the “have nots”, as only Energy and Communication Services posted positive returns. All other sectors posted negative returns for the period, with Real Estate and Utilities lagging the pack. Not surprisingly, Energy companies benefited from the rise in oil prices. Tight refining capacity after decades of very limited investment boosted Energy companies, as well. The global transition to additional energy sources will likely last an extended period of time, and traditional fuels will remain in demand. Communication Services companies benefited from a more durable than anticipated economy, as advertiser spending has been stronger than expected. Financials are finally benefiting from higher interest rates boosting income, as investors see regional banks on more stable footing after the tumult this spring. The perceived safe havens of Utilities and Consumer Staples lagged, as investors assessed sturdier economic data and the allure of stability waned. Consumer Discretionary lagged the benchmark, but topped four other sectors as retail sales readings topped estimates. Consumer spending represents around 70% of the U.S. economy, adding to the resilient economy narrative. Artificial intelligence (A.I.) remains the buzz in the Technology space, but investors may be realizing that monetizing A.I. may have a longer on-ramp than initially thought. Higher energy prices weighed on Industrials and Materials.

Long-Term View

It’s not a stretch to say the Federal Reserve is much closer to the end of their rate hike cycle than the beginning. After raising their policy rate 5.25% since March of 2022, they’ve stated that monetary policy is in restrictive territory, with that policy rate topping year-over-year inflation by over 1%. The question is now how long rates need to remain restrictive, rather than how much higher the policy rate needs to go. Moderating inflation is a positive development, as it simplifies some economic decisions that households and businesses face on a day-to-day basis and for longer time horizons. After falling for three consecutive quarters, S&P 500 earnings may nudge into growth territory in the 3rd quarter. Analysts have gradually boosted estimates, and momentum is in the right direction. Consensus also projects a return to solid earnings growth in the 4th quarter and into 2024, with those figures bumped higher of late. Stock prices and earnings tend to sync up over the long haul, and looking ahead, companies’ execution will tell the tale. As ever, we look to own companies whose management teams deliver consistent results.