Market Review

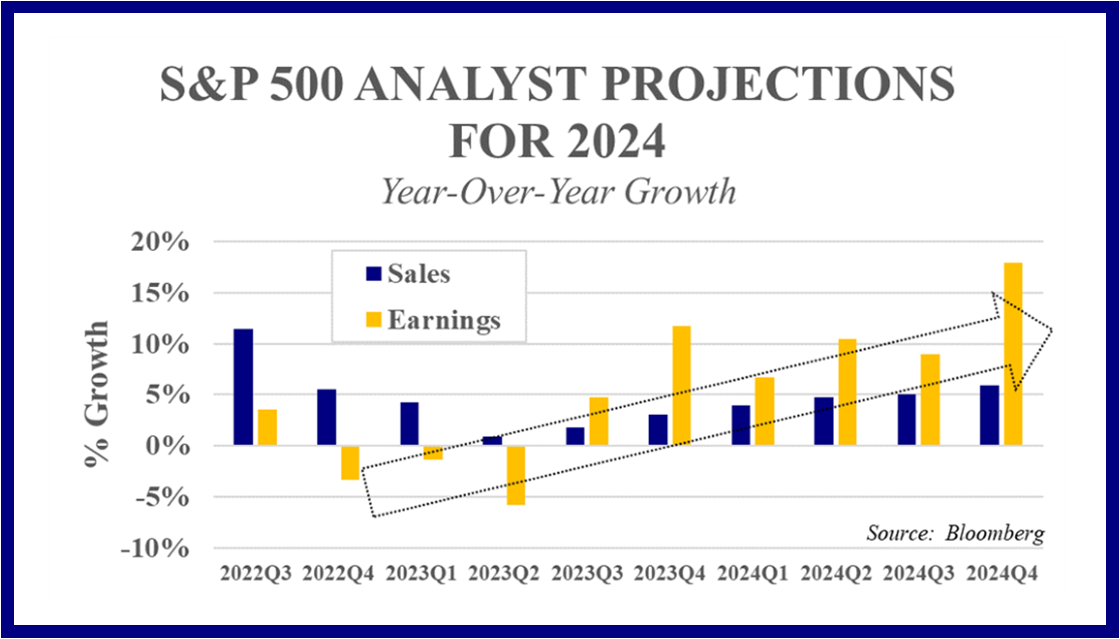

The benchmark S&P 500 index closed the 4th quarter up 11.2% after surging relentlessly upward from lows in late October. For the year, the index will close up over 24%, marking a sharp contrast to performance in 2022, though both years exhibited an emphatic bullish turnaround at roughly the same point on the calendar. The Federal Reserve has now left their policy rate unchanged at a 5.25%-5.50% range for three consecutive meetings, as inflation data has demonstrated a downward trend that’s proven reassuring to consumers, investors and policymakers alike. Corporate earnings grew 4.7% year-over-year during the 3rd quarter after contracting for three consecutive quarters, surprising analysts, who expected earnings would drop around 3%. Revenues managed to grow all three quarters earnings were shrinking, helped in part by pricing power, and expanded 1.8% during the 3rd quarter.

The Economy

The U.S. economy grew a surprisingly robust 4.9% during the 3rd quarter, when the consensus forecast began the quarter calling for no growth. That figure marked the fastest economic growth since the 4th quarter of 2021. Per the Federal Reserve Bank of Atlanta’s GDPNow model estimate, 4th quarter growth is tracking slightly above 2%, while the consensus projection points to growth of roughly 1%. Inflation as measured by the Federal Reserve’s favored Core Personal Consumption Expenditures Deflator continues to moderate versus year-ago levels, but remains above the desired 2% target. The most recent reading showed the included prices rising 3.2% year-over-year in November versus slightly over 5% a year ago. Consumer spending looks to have held up well during the holiday season, and the narrative points to a return of promotional discounts to ease pressures on consumer wallets. Businesses continue to hire at a healthy pace, and the unemployment rate continues to hold under 4%. That backdrop bodes well for consumer spending as we head into the new year.

Equity Markets

For all the talk of narrow market leadership during 2023, with a relatively small number of Mega Cap stocks driving market gains, the 4th quarter saw more broad-based upside participation. While half of S&P 500 stocks were down for the year through the end of the 3rd quarter, over 80% posted positive returns during the 4th quarter. From a sector perspective, only Energy posted negative returns, largely driven by oil slumping over 10%. Real Estate led the way, benefitting from a sharp drop in long-term interest rates as monetary policy rhetoric moderated in tone. Tech ran a close second and continues to benefit from the ongoing buzz over artificial intelligence (A.I.). Companies in the sector continue to roll out new products and features powered by A.I. Many of those same companies are also benefiting from increased focus on profitability and cost controls. Financials also outperformed the S&P 500 as the anticipated lower interest rates paid on deposits will benefit lender profits. Industrials continue to benefit from projects to expand and improve US infrastructure, including bringing parts of manufacturing supply chains back to domestic soil. Communication Services performed roughly in-line with the benchmark. The Consumer sector lagged as investors weighed the cumulative impact of multiple years of elevated inflation on households. True to form, Healthcare tends to lag into and during election years, as the sector gets dragged into policy debates and becomes a hot-button issue.