Market Review

The benchmark S&P 500 index posted a 8.3% gain for the 2nd quarter, with the strongest gains again concentrated among three sectors and a limited cadre of component companies. Artificial intelligence (A.I.) has been the hot news story in regards to which companies enable it and which companies are empowering users with it. The Federal Reserve raised their policy rate 0.25% in May, then kept the rate unchanged in June after ten consecutive hikes. S&P 500 earnings came in much better than anticipated, but still showed a 1.3% drop. Revenues topped estimates by 2.5%, expanding 4.2%. Market interest rates pushed upward to better reflect the current economic backdrop after a flight-to-safety during March saw the yield on the 5-year U.S. Treasury Note fall almost 1.0%. That 5-year benchmark currently yields around 4.1%. Regional bank turmoil which caused the sharp drop in yields seems to have subsided.

The Economy

The U.S. economy grew 2.0% during the 1st quarter, almost twice the consensus forecast. Per the Federal Reserve Bank of Atlanta’s GDPNow model estimate, 2nd quarter growth is tracking just above 2.0%, in contrast with a consensus expectation of slightly under 1%. Commodity prices have continued to fall over the past three months, with welcome drops in food-related categories. Inflation continues to trend lower, but does so at a frustratingly slow pace toward the established 2% year-over-year targeted increase. Progress, nonetheless, is progress. The housing market continues to improve in terms of new home sales and homebuilder sentiment, and housing starts jumped sharply in May. Mortgage rates have stabilized after rising sharply in 2022, albeit at markedly higher levels than prevailed over the previous decade. For observers of a certain age, however, a 7% mortgage rate doesn’t sound crazily high. Home construction can help address a supply shortage has led to a surge in prices since 2020 and negatively impacted affordability for many consumers.

Equity Markets

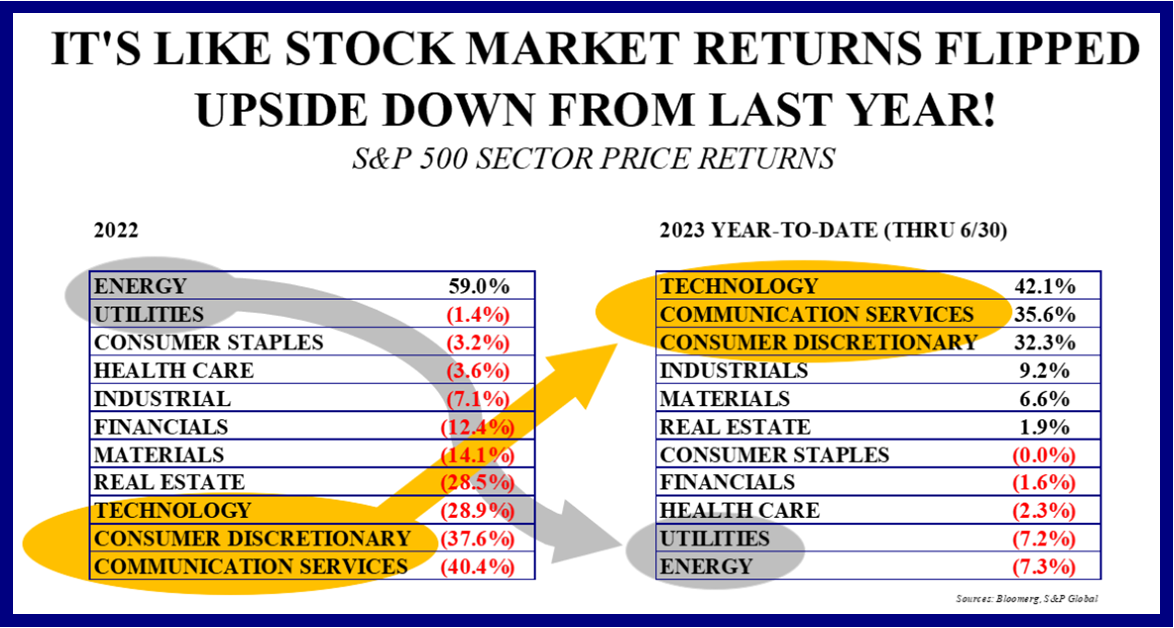

Once again, only three market sectors posted returns topping the overall S&P 500, and those did so by a sizeable margin. An additional three sectors posted positive returns for the quarter. Technology again topped all sectors for the period, with Communication Services and Consumer Discretionary also besting the benchmark. With all the buzz over artificial intelligence, investors see companies in all three sectors benefiting from adoption and use related capabilities. Technology companies provide the hardware and software infrastructure that powers the artificial intelligence ecosystem. Tech companies also provide cybersecurity that allows much of the infrastructure to exist in the Cloud. Communication Services companies can use the advancements to tailor content for viewing and even generate content. Discretionary companies can tailor shopping experiences and make sure consumers get what they’re seeking more easily. Financials, Industrials and Healthcare also posted positive 2nd quarter returns, but lagged the S&P 500. Financials benefited from very limited fallout from the 1st quarter’s stresses, and 23 major banks all passed the Fed’s annual stress test. All sectors will benefit from A.I. advances, but it’s most clearly and currently evident in the three market-leading sectors. Consumer Staples and Utilities posted negative returns, as investors saw less need for safe havens. Energy again lagged all other sectors, as global economic growth hasn’t provided much of a boost to demand.

Long-Term View

The consensus forecast is for stocks to post modest returns over the remainder of 2023, though an increasing number of analysts have upped their year-end price targets for the S&P 500. As the saying goes, history does not repeat itself, but it often rhymes. If history is a guide, strong stock market performance during the first half of the year is typically followed by a positive run for the rest of the year. Given the surge through the end of June, it seems reasonable that gains could moderate through year-end. Truth be told, most investors would likely be happy if the stock market merely held its sizeable gains for the rest of 2023. Economists anticipate growth slowing in the second half of the year, before accelerating through 2024. The economy isn’t the stock market, and investors are already looking toward projected earnings for next year, with those estimates on the rise. As ever, the stock market climbs a proverbial wall of worry. Patient investors tend to remain optimistic that businesses will improvise and adapt to overcome those worries, and over time that optimism has been rewarded.