Market Review

The benchmark S&P 500 index posted a 7.0% headline gain to start the year, though performance varied widely by sector and a small group of large, Technology-driven stocks provided the bulk of the gains. Investors sought the perceived safety of robust and resilient cash flows and balance sheets. As expected, the Federal Reserve moderated their rate hiking stance with a series of two 0.25% increases to the policy rate. Earnings results came in better than anticipated, but still showed a 2.5% drop. Revenues managed to top estimates by 2.0%, expanding 5.6%. Market yields rose to new highs for this cycle on stronger than expected economic data including inflation, before falling sharply in March to reflect expectations that tighter credit conditions will slow economic growth and curb inflation going forward. The yield on the 5-year US Treasury Note fell from a high over 4.3% to the current 3.6%.

The Economy

The U.S. economy grew 2.7% during the 4th quarter, roughly twice as fast as the consensus forecast for much of the quarter. Per the Federal Reserve Bank of Atlanta’s GDPNow model estimate, 2nd quarter growth is tracking slightly at 2.5%, in contrast with a consensus expectation of slightly over 1%. Commodity prices are sharply lower over the last twelve months, indicating goods inflation may largely be in check. Services inflation explains overall inflation remaining stubbornly high, largely driven by wage growth. Prospective employers find themselves having to pay up to add staff, as businesses have over two job openings posted for every person who is looking for a job. The large-scale technology sector layoffs making headlines and the prospects of a softening economy could drive potential new hires to go ahead and accept the roles on offer, and that could ease upward pressure on wages. Housing rental prices are moderating more quickly than is showing up in official statistics, and that development should also eventually help soften services inflation in the months ahead.

Equity Markets

Only three market sectors posted returns topping the overall S&P 500, though returns in those sectors were quite robust. Technology topped all sectors for the period, with Communication Services following close behind. Both sectors provided several companies on the relatively short list of those providing the bulk of the S&P 500’s gains. In an environment where inflation weighs on profit margins, companies within those areas have managed to cope a little better. Consumer Discretionary also topped the benchmark, as retailers work through surplus inventory and consumer spending remains remarkably resilient. Materials and Industrials also posted solidly positive returns, as companies are demonstrating effective expense management while supply chains improve. Financials trailed all other sectors, as liquidity issues at a small sampling of banks weighed on the sector. Energy also lagged, as oil and natural gas prices dropped on concerns slowing economic growth could weigh on demand, but the reopening Chinese economy could shift that narrative in a more positive direction. Real Estate lagged as office vacancy rates remain elevated and remaining tenants use less space. Consumer Staples companies have demonstrated pricing power, but revenue growth masks shrinking unit sales volumes. Healthcare was among the bottom sector performers, as investors consider patent expiration on a number of blockbuster treatments that could lower sector earnings.

Long-Term View

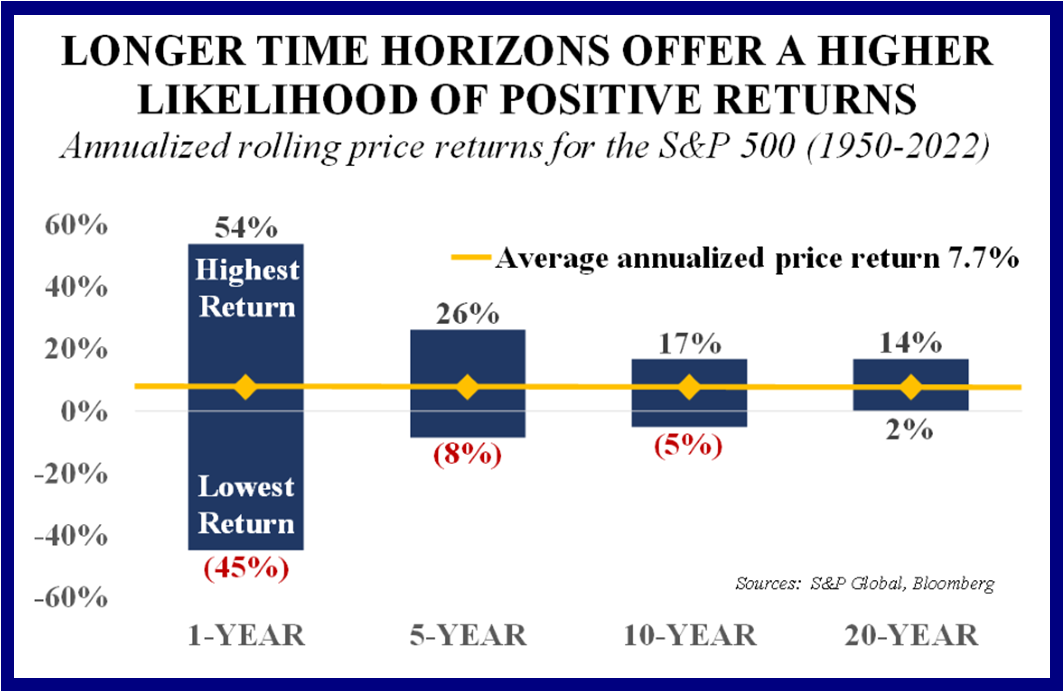

The consensus forecast is for stocks to post modest returns over the remainder of 2023, as economic data and the news cycle flow into earnings expectations. The Federal Reserve’s tightening cycle has been the most aggressive since the early 1980s, and it’s reasonable to anticipate that those moves will begin to dampen growth and exert downward pressure on inflation. Market expectations point to the central bank eventually finding success in bringing inflation to bay, though progress will likely not be on a straight line. Analysts forecast earnings growth will improve during the second half of the year, as companies face easier comparisons versus 2022 and profit margins expand due to lower input costs and moderating wage pressures. It could well shape up as a year where income in the form of dividends and interest is an investor’s friend, comprising a larger portion of returns than in much of the past decade. The uncertainty in the air shouldn’t breed a sense of urgency to alter a thoughtfully-crafted investment approach that’s intended to weather even times like these with peace of mind.