Market Review

After a 2nd quarter most investors want to forget, the smaller 5.3% S&P 500 drop experienced in the 3rd isn’t any easier to swallow. The net move masks a tale of two markets, with a sharp rally followed by a slightly sharper pullback. Stubborn inflation kept the Federal Reserve on a path toward more restrictive policy, lifting their target rate 1.5% to the highest level in almost 15 years. One positive development is that investors can now buy a risk-free 2-year US Treasury Note and earn over a 4% yield to maturity, versus the paltry 0.25% on offer a year ago. Rising longer-term interest rates continue to weigh on bond prices, with the price of the 10-year US Treasury Note falling 4% as the yield rose 0.50%. Earnings results continue to surprise to the upside in aggregate, outpacing consensus estimates by 4.1% to post 8.0% year-over year growth in the 2nd quarter. Revenue growth topped estimates by 2.6%, at a 13.7% pace.

The Economy

The U.S. economy contracted 0.6% during the 2nd quarter, shrinking consecutively for the first time since 2009 outside of pandemic shutdown in 2020. Consumer spending rose 2.0%, and continues to be comparatively resilient in the face of elevated inflation and a downbeat news cycle. Continued labor market strength likely helped buoy consumer spending. The unemployment rate rose slightly, but because additional people started to actively look for work as employers are hiring. Commodity prices fell sharply during the quarter, and drivers are spending about 25% less on a gallon of gas than they were in June, further helping consumers. Supply chain impediments continue to provide logistical challenges, but commentary is starting to indicate improvements at the margin, though there’s plenty of progress to be made. Mortgage rates hit the highest levels since 2001, approaching 7%. These rates will likely weigh on homebuilding, but slow price appreciation that might deter buyers. The Fed indicates further rate hikes are in order until inflation is solidly trending downward.

Equity Markets

Stock price performance was negative across most market sectors, with only Consumer Discretionary and Energy posting positive returns. With a narrative of economic slowdown so pervasive, consumer spending surprised to the upside. Households are enjoying being able to travel and dine out. While oil prices fell sharply during the quarter, current prices still provide a positive backdrop for producer and refiner profits. There is also renewed emphasis on natural gas production in the US, with the commodity in short supply in Europe. Financials posted performance toward the top of the pack, as higher interest rates boost net interest margins, even after paying higher rates on deposits. Industrials were next in line on performance, as secular trends like electrical grid sturdiness seem intact despite concerns over an economic slowdown. Tech performance proved comparatively resilient, as many business models have proven less cyclical than they’ve historically been for the sector. Consumer Staples lagged in something of a giveback after the sector’s perceived safety made it an early performance leader in 2022. Materials lagged, as a global economic slowdown weighs on demand, and the sector is highly cyclical. Communication Services and Real Estate brought up the rear in performance. Lagging ad revenues weighed on media companies, and a slower-than-expected 5G demand cycle weighed on telecoms. A slow return to the office weighed on Real Estate.

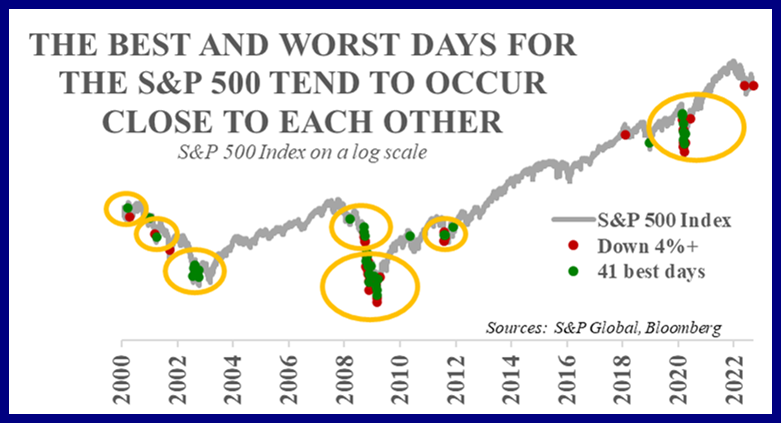

Long-Term View

Markets hate uncertainty, and uncertainty abounds at present, with geopolitics intertwining with global commerce flow. Even amid that backdrop, there are companies that continue to execute well and to improvise and adapt to overcome the challenges that arise. Costco will be selling Christmas trees this fall that arrived too late to sell in 2021. For all the supply chain snarls, the 2022 tree supply arrived early! Adversity tends to force change and evolution upon companies, and they tend to emerge as improved versions of themselves, executing more efficiently and innovating all the while. Knowing the outcome of the mid-term US elections may remove some uncertainty. With history as a guide, mid-term years tend to be choppy for the markets until the voters speak in early November, and that’s without additional complications. Perhaps removing one element of uncertainty provides a positive market catalyst. Inflation trending lower would definitely be a positive catalyst. Outcomes are only evident in hindsight, but having a solid plan in place allows for weathering many potential outcomes.