Market Review

The benchmark S&P 500 index closed the 1st quarter up 10.1% continuing its march upward after last October’s market low. While the 26%+ gain since October is noteworthy, the index is only up around 9% from the high in January, 2022. Corporate earnings beat analyst estimates by over 7% during the 4th quarter, growing almost 8% year-over-year. Revenues surprised to the upside by slightly over 1%, growing almost 4% versus the prior year. Analysts project earnings will grow 5%+ in every quarter of 2024. The Federal Reserve has now left their policy rate at a 5.25%-5.00% range for five consecutive meetings and Chair Powell has gone on record as saying a rate cut is likely their next move once members have more confidence that inflation is moving toward their 2% target. Per those comments, a rate cut would likely come before inflation is actually at 2% to prevent inflation overshooting to the downside.

The Economy

The U.S. economy grew at an above-trend 3.4% during the 4th quarter, when the consensus forecast began the quarter calling for an anemic 0.5% pace of growth. That figure for 4th quarter growth matched the rate of expansion for the full year. Per the Federal Reserve Bank of Atlanta’s GDPNow model estimate, 1st quarter growth is tracking slightly under 3%, which is almost 1% higher than economist expectations. Encouragingly, inflation as measured by the Federal Reserve’s favored Core Personal Consumption Expenditures Deflator continues to moderate versus a year ago, but the pace of progress has slowed compared to the last year’s cadence of declines. Fed members note this improvement but want to see indications that lower inflation is both continuing and enduring before embarking on rate cuts to prevent their monetary policy stance from becoming overly restrictive. Economists anticipate overall economic growth and consumer spending will remain healthy through 2024, as the labor market remains robust and wage gains exert less pressure on consumer wallets.

Equity Markets

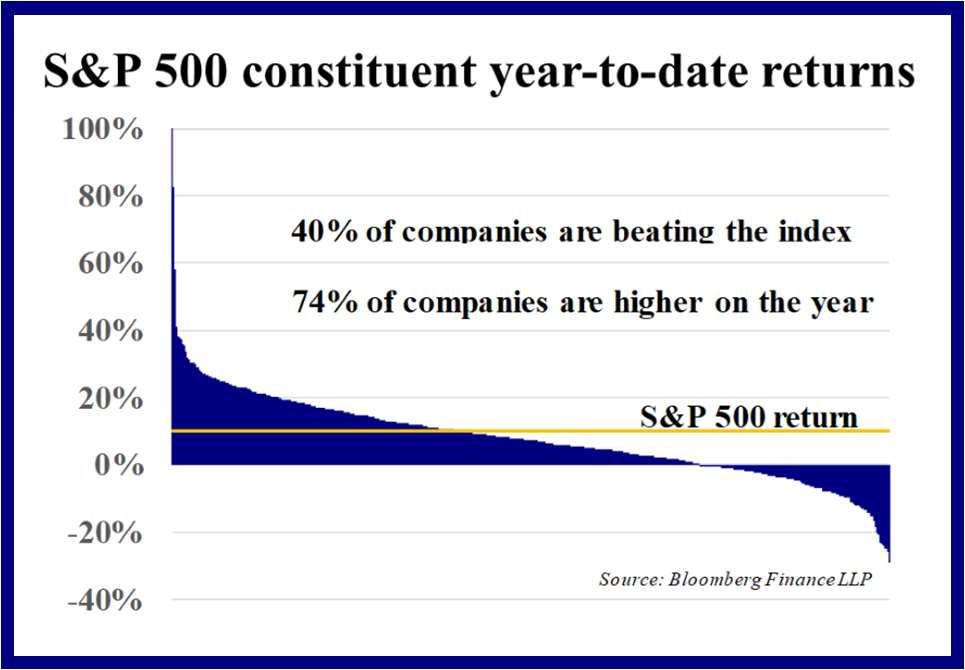

A limited number of stocks still garner the bulk of financial news headlines, but more and more stocks are participating in the market rally, with over 70% of S&P 500 companies and 10 of the benchmark’s 11 sectors posting positive returns year-to-date. Five sectors topped the index’s returns, with Communication Services leading the way, up 15.5%. Energy stocks were up 12.7%, as oil prices largely trended higher. Technology stocks have also outdistanced the broad market, rising 12.5%. The excitement over Artificial Intelligence (A.I.) continues and looks warranted. Companies are delivering real hardware, software and earnings, driven by A.I. investments. Comparisons to the ill-fated Tech surge in the late 1990s seem a stretch, given that today’s companies are both promising and delivering tangible outcomes they can monetize. Financials (+12.0%) and Industrials (+10.6%) also beat the index, adding to the Cyclical flavor of the top-performing sectors so far in 2024. One year on from several high-profile regional bank failures, large-cap S&P 500 Financial names look fairly stable while capital markets activity picks back up. Healthcare lagged after a hot start to the year, moving sideways during March as much of the rest of the stock market continued trending upward. As is often typical during a rallying market, Real Estate trailed all other sectors, as troubled office properties seemed to weigh on the broader sector, and investors favored growth-oriented names.

Long-Term View

Commentators still make a big to-do about central bank policy meetings, parsing the post-meeting statement and press conference commentary for nuanced word choices that may telegraph policymaker thinking and plans, but investors have moved the Federal Reserve to the back burner. The window to hike rates to throttle back inflation has passed. The window to cut rates to boost flagging growth hasn’t yet arrived and doesn’t look imminent. If anything, monetary policy has entered a maintenance period where rates may need to be trimmed slightly to fine-tune the policy stance. With no Fed to fight or avoid fighting, the focus turns to earnings and execution and idiosyncratic differences between market sectors and individual companies. What differentiators will drive value and create moats? Investors rewarded companies who executed and delivered on 4th quarter results and punished companies who fell short or reeled in future expectations. That arithmetic is as it should be. Management teams look to set attainable goals and then deliver, with the knowledge that earnings and stock prices will sync up.