Market Review

The benchmark S&P 500 index posted a welcome 7.1% gain to close out a challenging calendar year. Earnings results continued to surprise to the upside, although overall growth was more modest, with a 3.5% rise outpacing expectations for no growth. Revenue growth topped estimates by 2.5%, expanding 11.4%. Despite a flurry of four central bank rate hikes, including two in the 4th quarter, and a highly negative news cycle, the broad market trades roughly where it was in mid-June. Market yields have fallen from what look to be at least near-term highs, with yields on 2-year and 10-year US Treasuries down over 0.30% since peaking. Some of that movement is due to a potential inflection point for inflation. Consumer prices rose less than expected in both October and November, and continuation of that trend would see data running at levels consistent with the Federal Reserve’s inflation target.

The Economy

The U.S. economy grew 3.2% during the 3rd quarter after contracting for two consecutive quarters. Consumer spending rose 2.3%, slightly stronger than in the 2nd quarter. A strong labor market with an extremely low unemployment rate and rising pay may continue to buoy consumption. Drops in prices for a broad swath of commodities should also benefit consumers and businesses. Drivers will notice gasoline prices have continued to fall, and fresh food prices have moderated and even fallen in some categories. In spite of positive news on goods prices, inflation has proven stickier for services. Hospitality and travel businesses are having to increase pay to up staffing levels to match increased demand from a public increasingly “doing stuff” rather than “buying stuff”. Supply chains continue to improve, but remain problematic in certain industries. Mortgage rates have fallen almost 0.7% since peaking in the 4th quarter, but remain much higher than at the beginning of 2022. The housing market is definitely operating at a slower level than much of the economy.

Equity Markets

Stock price performance was positive across most market sectors, with nine of the 11 rising for the quarter. Cyclical sectors both led and lagged. Energy topped all sectors, as changing global supply and demand dynamics benefit U.S. oil and gas producers. Industrials also performed strongly, as secular tailwinds from a number of directions have made earnings results rather resilient. Materials often tend to perform in line directionally with Industrials and Energy, given typically similar business drivers. On the other side of the performance spectrum, Consumer Discretionary lagged all other sectors by a wide margin, as many retailers mark down prices on supply chain-related excess inventories and consumers spend more cautiously. Financials continued the trend of cyclical sectors performing well, as higher interest rates boost revenues. Proactive management has also made bank balance sheets more robust. Investors also favored Consumer Staples and Healthcare, two sectors known for consistent user demand even amid uncertain backdrops. Technology lagged the broad market slightly, as demand for devices enabling remote work has moderated. Real Estate posted positive returns, but higher interest rates raise borrowing costs for financing property. The linkage with consumer-oriented tenants also provided a headwind. Lower advertising revenue continues to weigh on Communication Services stocks, and that also feeds from consumer concerns.

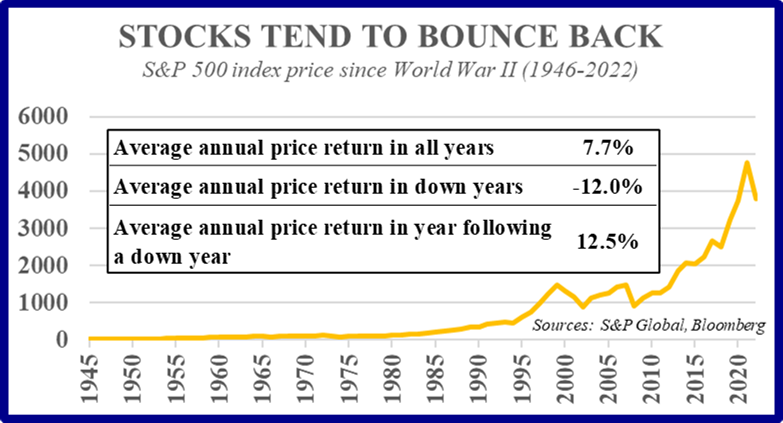

Long-Term View

The consensus call is for stocks to experience a choppy start to 2023 and the lagged impact of 4.25% of Federal Reserve rate hikes to weigh on economic growth. Central bankers feel that a lower pace of G.D.P. growth will help reduce inflationary pressures and get price increases back toward their 2% year-over-year target. The Federal Reserve does, however, have a dual mandate to both manage inflation and promote maximum employment. Recent comments suggest they feel they are nearing their peak policy rate and likely pausing rate hikes early in 2023. At that point, they will take time to observe the impact their cumulative moves are having on both mandates. An extended period of an elevated policy rate could potentially ensure inflation has been tamed. Starting from an elevated rate would also mean they would have plenty of ability to stimulate economic growth with rate cuts if employment starts to fall short of goals. A pandemic and resulting supply chain snarls dealt central bankers an unenviable hand, and time will tell how deftly they have navigated the ensuing challenge.