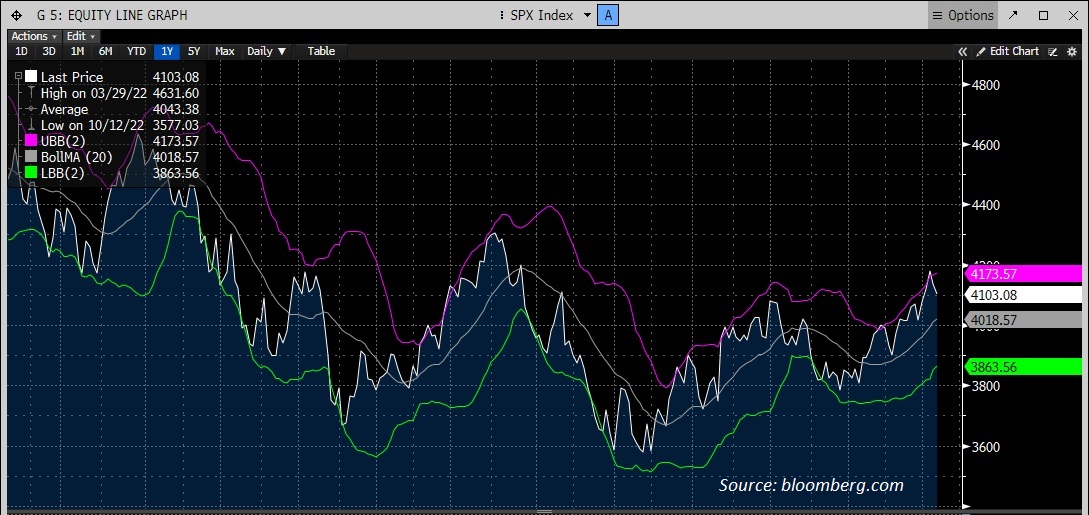

Did the S&P 500 bottom on October 12th of last year? Only hindsight will bestow that

knowledge. Stubborn inflation and higher interest rates were the big drivers behind the selloff that took us to that October low, but recent data indicates inflation is retreating, comments from Federal Reserve members suggest they may be close to ending their rate hike cycle and longer-term interest rates have retreated a good bit from the highs we saw last year.

Some would argue longer-term interest rates are falling in expectation of a looming recession. Were it to come about, said recession would likely be the most predicted downturn in history. Recession aside, it’s understandable investors would be tempted to buy a 5-year Treasury Note north of 3½%, when a comparable yield was last available in 2008. That’s the yield available today, which is about 1% lower than the peak 5-year rate from last year.

Commentators fairly note that the stock market has never bottomed prior to a recession

actually starting. In spite of two quarters of negative GDP growth to start 2022, the National Bureau of Economic Research, the official designator of recessions, never declared that the US economy entered a recession. There were certainly sectors of the economy operating in a recessionary state, while other sectors remained more resilient. That still looks to be the case now. As GDP posted two solid quarters of growth to finish the year, commentators pointed toward something of a rolling recession, where sluggish growth rotated through different

sectors of the economy without creating a broad-based recessionary environment. A sturdy job market certainly helped the broader economy weather the proverbial storm. Could there have been a full-scale recession that eventually rolled through most of the economy without an official recession being declared? That brings up an interesting question, but such a scenario could make an October market bottom more plausible.

Much has been made of the inverted yield curve, that is the positioning of longer-term interest rates lower than shorter-term interest rates, as a harbinger of recession. History demonstrates that inverted yield curves precede recessions, as the forward-looking market prices in the eventual economic downturn, but the stock market hasn’t historically fallen 20+% by the time the yield curve inverts for an extended period. Typically, the yield curve inverts before stock prices start to fall. It’s as if more cynical bond market investors sniff out the hint of an economic downturn before more optimistic stock investors. Investors typically allow themselves think “this time is different” at their peril, but certain aspects to this market cycle don’t sync with historical experience.

If there is a recession in 2023, it’s realistic to expect corporate earnings to drop from 2022 levels that remained fairly strong for most of the year even, as stock prices tanked. Stock prices are a function of expected future earnings and the interest rates analysts use to determine what those future earnings are worth today. The price of the S&P 500 is roughly 16% lower than it was at the all-time high in January of last year. Chalk some of that drop up to higher interest rates and some of it up to lower earnings expectations than were priced in at the high.

Certainly, earnings expectations for 2023 have been reeled back in. As for fair value for the S&P 500 at any point in time, it’s been said fair value is something the market careens past on the way to being undervalued or overvalued, but it stands to reason that stock prices reflect a dose of bad news.

A recession would definitely represent bad news, but recessions eventually end and the stock market begins to price in that economic recovery before it occurs. If history is a guide, stocks bottom first, followed by economic growth and eventually corporate earnings. Since stocks are forward-looking, prices have historically turned higher while the news narrative still reads as awful. Many investors wonder how in the world stock prices could be rising amid such negative headlines. The market, however, isn’t reading today’s headlines, but rather anticipating the headlines six to twelve months ahead that will likely be less painful to read. That dynamic

illustrates why the stock market is said to climb a wall of worry to post gains.

Is the stock market starting to price in a recovery from a recession that hasn’t yet occurred and isn’t guaranteed to occur? Is a rolling recession underway that won’t actually look like a textbook recession or be declared as such? The passage of time will reveal the answers to those questions, but the next bull market will likely begin when good news seems hard to find…and there’s no bell to signal the bull run is starting!

How can investors make sure they’re participating when that bull market starts? The most important step is to have a healthy allocation to stocks that still allows for peace of mind in years like 2022. Remember that not every stock was down in 2022. Owning stocks that pay generous dividends can also help with that peace of mind in challenging years. That healthy stock allocation sets investors up to benefit when the next bull market starts because they’re already invested when stocks start to seemingly levitate amidst a sea of bad news.