The age-old advice is to “buy low and sell high”, and it’s hard to argue with that logic. We cling steadfastly to the belief that if you buy and stay invested over the long term, you’ll have done exactly that. With history as a guide, the stock market has rewarded investors handsomely, but the path toward higher prices hasn’t exactly been a straight line upward.

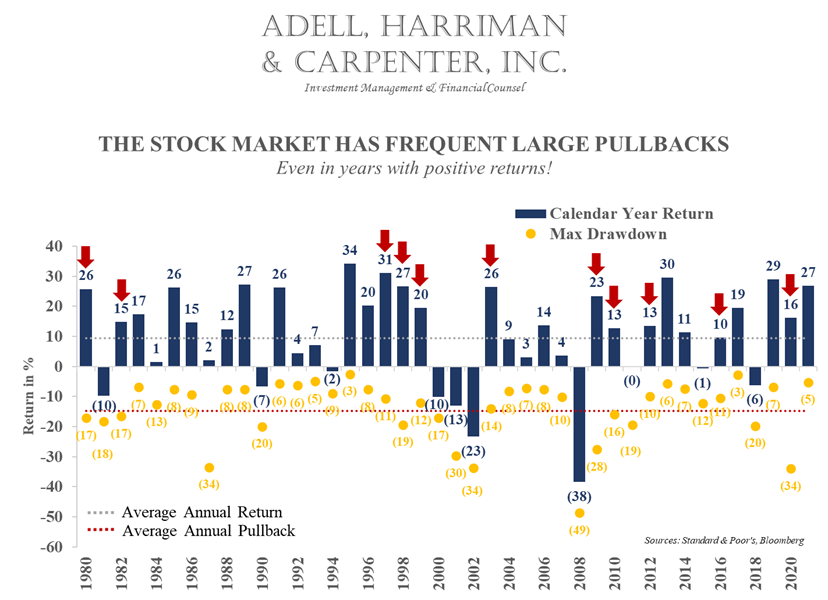

Volatility has always been, is currently and will forever be a feature of the stock market. Truth be told, that volatility is why the rewards have been so attractive over the years…if you could hold on for the sometimes bumpy ride. Those rewards have accrued to stock investors because there’s a tradeoff between risk and reward. If investors can tolerate higher risk in the form of volatility (bumps in the road), then there’s an opportunity to earn higher returns. Looking back over the past forty or so years, there have been a lot more years where stock prices have been up in aggregate than when they’ve been down. To put a number on that fact, the S&P 500 has been up almost 80% of those years, with an average return across all years of around 9½%.

Those annual returns, however, only tell part of the story. It’s sort of like the duck gliding elegantly across the water, only the duck feet are working pretty darn hard under the water to make that glide look effortless. Across all those 40+ years, the average pullback from a previous high to an eventual low during each year has been 14%. We’ve seen some white-knuckle stretches even in years with spectacular returns.

There’s something about the way humans are wired that makes losses feel more painful than gains feel enjoyable. Truth be told, though, losses haven’t really been incurred unless investors sold at depressed prices and missed out on future gains. That truth illustrates why investors are wise to park assets they’ll need to tap into in the near-term in less risky assets like cash or bonds, even when interest rates are very, very low.

Those white-knuckle stretches can be unsettling, or at least unpleasant, for even the most stoic investors. In those circumstances, a set of questions may help settle nerves, because the answers are unlikely to change dramatically over time.

Have my reasons for investing changed?

Have my goals changed?

Has my time horizon for needing money changed?

Am I skillful or disciplined enough to get back into the market after a pullback has occurred?

For most investors, the answer to all four questions will be “no”, so what prescription does that reveal? “Hurry up and wait” may not seem terribly insightful or inspirational, but with history as a guide it has proven to be the cure for what ails investors when stock prices pull back.