Interest rates should rise when economic growth accelerates…and history says stocks prices may well rise alongside them

The stock market has frustrated many investors of late and commentators keep pointing toward the bond market and rising interest rates for the reason. Interest rates have actually been rising since last August. The yield on the 10-year US Treasury Note was 0.50% in early August of last year, passed 1.00% in early January and currently sits a little over 1.50%. Over the course of that 1.00% move in yields, the S&P 500 has handsomely appreciated about 18% and two quarters worth of earnings reports have blown away analyst estimates on the aggregate. That big-picture snapshot indicates rising interest rates haven’t really been all that bad for stocks. So why the sudden market indigestion?

In general, the financial markets prefer slow and steady adjustments. Moving from a 0.50% 10-year Treasury yield in August to 1.00% in January qualifies as that sort of move. The move from 1.00% to where we are now has been a little sharper over the course of about six weeks. It’s the speed of this most recent move in yields and the fears of inflation it raises rather than the size of the move that have apparently caused stocks to wobble. From a historical perspective, though, interest rates are still pretty darn low and represent very accommodative financial conditions. From 2000 through the Great Financial Crisis, the 10-year Treasury yield was mostly between 4% and 5%. For the past decade it’s mostly been between 2% and 3%.

Many investors remember the energy-driven bouts of inflation the US faced during the 1970s, but the background today is very different. First and foremost, the US economy in 2021 is far less dependent on foreign suppliers to meet energy needs, lessening the chances of a supply-driven inflation shock. In addition, the nation uses energy much more efficiently than 40-50 years ago, so there’s less demand for commodities like oil and energy makes up less of corporate and household budgets now. Wage pressures can provide another potential source of inflationary pressures, but there’s currently a lot of slack in the labor market as many service industries have essentially been shut down by the health crisis. Payroll statistics show there are 8.5M fewer people employed than early last year, and an additional 4M individuals have left the labor force for various reasons and aren’t even looking for work. From a longer-term, macro perspective, technological innovation and an aging population represent massive forces pushing against inflation. Investors are wise to think in terms of probabilities when considering outcomes, and for all the shrill warnings about inflation since the Great Financial Crisis, 1970s-style inflation does not appear to be a high-probability outcome.

The consensus expectation for 2021 US GDP growth is 5.5%. That pace of growth would be the fastest since 1984 and offers a big reason why interest rates are – and should be – rising. Accelerating economic growth should produce higher corporate earnings, and higher earnings should translate into higher stock prices. Attractive stock returns mean bonds probably need to yield more in order to attract investors. As a forward-looking mechanism, the stock market has already priced in at least some of this good news on better economic growth and its impact on earnings. Bonds, however, have a been a little slower to react. The Federal Reserve has been buying large volumes of Treasury bonds to provide economic support, and that action has muted yield movements. It’s still natural, however, for yields to move higher on stronger economic growth or expectations for it.

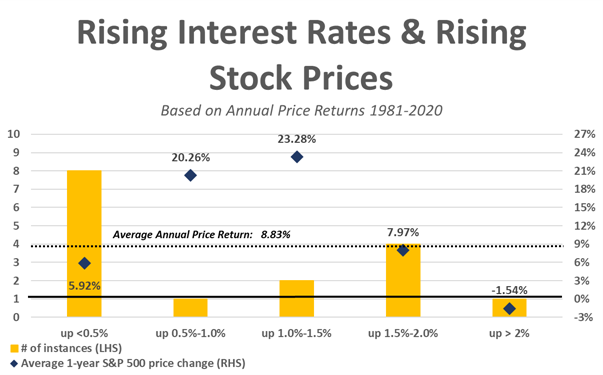

Interest rates are rising for a very positive reason. More widely spread vaccinations should help increase social mobility and thereby help boost economic growth. Stronger economic growth is often what pushes interest rates higher, and historically higher interest and higher stock prices have on average gone hand-in-hand. In the 40 calendar years beginning with 1981 and ending in 2020, the 10-year Treasury Note has risen in 16 of those years, or 40% the time. Within those rising rates years, the S&P 500’s value has risen almost 70% of the time (11 years) with an average annual price appreciation of just under 9%. There are no sure things in investing. Anyone who claims to have found a sure thing is either fibbing or deluded. That being said, good news is pushing bond yields higher and there is good reason to believe those higher yields are pointing to good news for stock prices.