Market Review

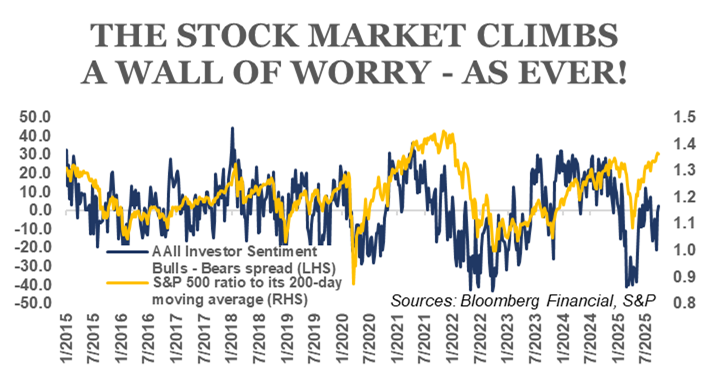

The benchmark S&P 500 index closed the 3rd quarter up 7.8% to mark a second consecutive quarterly gain and take year-to-date appreciation to 13.7%. That market movement contrasts with investor sentiment, as the market climbs a proverbial wall of worry. The news of note is that companies continue to report financial results that handily outpace forecasts. Corporate earnings beat forecasts by almost 8%, growing at over 12¾% year-over-year, marking a third consecutive quarter of double-digit growth. Revenues surprised more modestly, by slightly over 2%, growing around 6.3% versus the prior year. Analysts project that earnings shrank slightly during the 3rd quarter and will grow at round 6½% during the 4th quarter. The Federal Reserve (“the Fed”) left their policy rate unchanged at their July meeting and cut that rate by 0.25% in mid-September. The Fed noted slower job growth and offered the opinion that the labor market is no longer “very solid”, with downside risks to employment rising amid inflation that remains “somewhat elevated”.

The Economy

The U.S. economy rebounded to positive growth of 3.8% during the 2nd quarter, showing over twice the growth the consensus projected as the quarter began, as net imports exerted less of a negative influence on the math behind G.D.P. calculations. Per the Federal Reserve Bank of Atlanta’s GDPNow model estimate, 3rd quarter economic activity will again expand around 3%. Inflation readings on the central bank’s preferred Core Personal Consumption Expenditures Deflator remain low by historical standards but reflect higher recent prices on imported goods. The Fed’s post-meeting statement in September indicated that they expect slightly higher inflation during the rest of 2025 and no material increase in the unemployment rate into next year. Economists anticipate the U.S. economy will grow a below-trend 1.1% during the 4th quarter and a trend-like 1.7% in 2026. The unemployment rate remains 0.8% above the cycle low of 3.4%, and remains quite low by historical standards, even during times of solid economic growth. Market interest rates on US Treasury securities fell modestly during the quarter, but mortgage interest rates actually rose around 0.6%, which will provide something of a headwind for the housing market.

Equity Markets

The S&P 500 topped most sectors during the 3rd quarter, trailing only Technology (+13.0%) and Communication Services (+11.8%). Every sector closed the quarter in positive territory, though the two leading sectors outpaced the index by a sizeable margin. Tech and Communication Services continue to benefit from massive demand for the artificial intelligence (“A.I.”) and Cloud infrastructure those companies provide as more and more companies step into efforts to tap into the use cases A.I. present to make business more efficient. Both hardware and software play a role in implementing A.I. solutions. Energy firms (+6.0%) continue to benefit from data centers’ huge need for electrical power and the natural gas that allows for getting new generation online fairly quickly. Independent power producers look to be a ready source of increased generation, as they don’t face the same regulatory constraints as Utilities in terms of getting new projects approved to build. Consumer stocks booked a 5.3% gain, as the sector benefits from Amazon’s presence and the company’s position as the leading provider of Cloud services by market share. Industrials (+4.5%) play a key role in the A.I. and Cloud infrastructure buildout as they erect the data centers than house the related hardware, connect those facilities to sources of electric power and connect that power to the equipment inside the data centers. Healthcare (+3.3%) stocks have in general faced fewer policy headwinds during the 3rd quarter, but the sector has fewer obvious positive catalysts than many other sectors. Financials stand to benefit from lower short-term interest rates and somewhat stable longer-term interest rates, as that dynamic increases the net interest margin firms earn on what they earn from the assets they own vs. what they pay on deposits. A lighter regulatory touch should also help boost capital markets activity like mergers and acquisitions (M&A). Materials stocks (+2.6%) are benefiting from supplying the raw materials needed to build data centers and power generating plants. Real Estate (+1.7%) stocks tend to perform well in environments where interest rates are falling, as the sector’s typically generous dividends become relatively more attractive, but the sector trailed all other sectors during the recently-ended quarter.

Long-Term View

October brings the onset of another round of companies reporting their financial results for their most fiscal quarter. Revenue matters, and so do earnings per share. The line-items underneath those headline announcements matter, as well. How do profit margins look? How do operating expenses look? Which product lines are performing well with customers? Taken all together, those fundamental data points give investors an in-depth look about how a company executed last quarter, but they’re all backward-looking. The stock market is a discounting mechanism, meaning that stock prices reflect what investors think will happen in the future. With that in mind, market participants pay close attention to what management teams think will happen in the future. Not every company provides forward-looking guidance. Sometimes that’s due to established company policies, and sometimes it’s due to poor visibility into near-term or longer-term developments. That lack of visibility can be due to geopolitical developments, company-specific headwinds or policy uncertainty. Even with management guidance, the future is uncertain, but it’s reassuring to check every quarter and see whether management teams have been executing well and have been good stewards of the companies in client portfolios.