There’s plenty of sagely advice available from savvy investors. One thing most of them have in common is they stay invested. They may keep some cash on the sidelines to take advantage of unexpected opportunities. They may dial stock exposure up when they think it’s appropriate, and they may dial it down when they deem that prudent. They may shift more of their portfolio into defensive stocks if they think a pullback is likely. They’ll certainly trim holdings that have gotten outsized on market moves and add to areas that have shrunk below target allocations. That “gardening” applies to overall asset classes like stocks and bonds, to sectors within asset classes and to positions in individual companies. The key point is that the changes are at the margin. There is no binary “all in or all out” decision.

Market moves can be unsettling at times, whether it’s a sudden plunge like last spring or a grinding bear market like during the Great Financial Crisis. Volatility has been, is and always will be a feature of the stock market, but a willingness to ride out that volatility has rewarded investors over time.

That being said, investors do need the peace of mind to sleep at night, and that’s where marginal portfolio adjustments come in. Dialing back stock exposure by a pre-set amount at times may help on that front, but the incremental nature of the move means it won’t cause lasting damage to portfolio returns if the market keeps rallying.

The long-term trend in the stock market overall has been toward higher prices, but the market has zigged and zagged in what has been termed a “random walk”. The trend toward higher prices has indeed been investors’ friend, but those seemingly random moves to get there have made it challenging to predict short-term movements with any high degree of certainty or consistency. Adding to the complexity, market sentiment is often most optimistic right before a downturn’s onset and most pessimistic right before a new bull market is born.

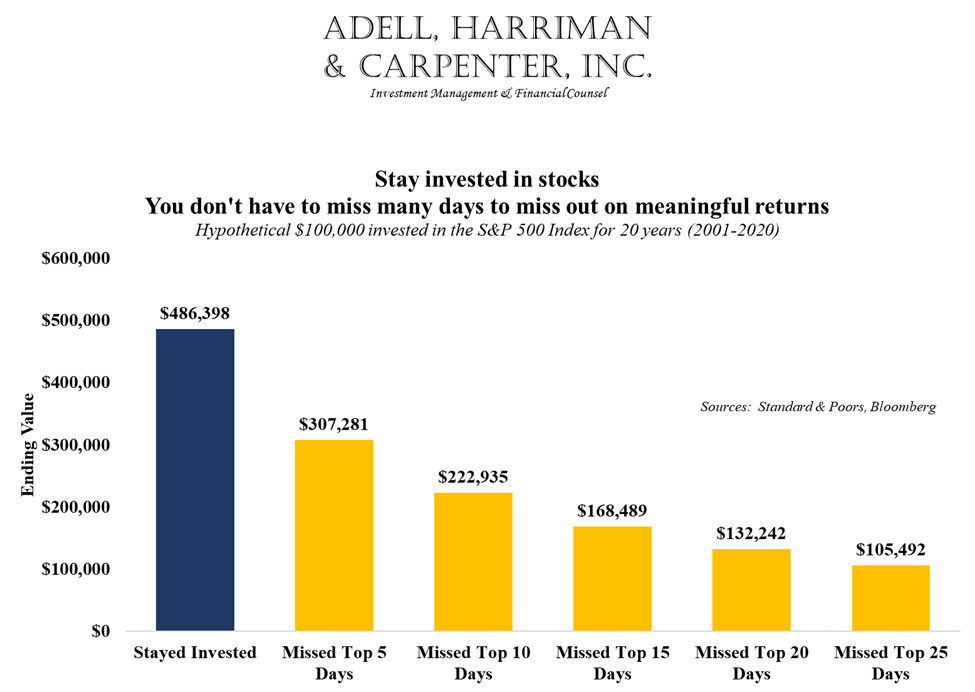

That unpredictability is why the most successful investors stay invested, even if they make portfolio adjustments at the margin. Those investors likely have a chart like the one below, and they probably reference it regularly.

Those highly successful investors may have a “secret sauce” that gives them an edge in picking individual stocks or making those marginal adjustments, but the real keys to investing success are no secret:

- Start investing.

- Keep investing additional funds as you’re able.

- Stay invested.

Working with a professional advisor can help investors navigate turbulent waters by constructing a portfolio that can still generate consistent and predictable cash flow during market downturns and helping them stick with a durable long-term plan.

We’d welcome the opportunity to chat with you about your investing journey.