We don’t enjoy checking the morning news to hear “stocks will likely open lower this morning (again)”. We’re invested alongside our clients, so we’re seeing the same impact on our retirement savings. That being said, market pullbacks are a normal part of stock trading patterns. There will be stretches where the market trends downward. Those trends are often related to occasional periods of lackluster economic growth or – as evident lately – uncertainty. Uncertainty understandably makes investors want to rein in risks. Psychological studies have repeatedly demonstrated that humans feel the pain of investment losses much more acutely than we enjoy watching portfolio values rise. History shows, however, that if we stay the course with a well-reasoned investing plan that those losses have been transitory – contained, temporary and reversible.

The stock market has been a tremendous wealth creation engine, and we hold to the belief that will continue to be the case for long-term investors. Different sectors of the market and different companies will lead the market forward at different points in time, but we steadfastly believe the long-term market trend will continue to reward investors who ignore the short-term noise and accompanying bouts of nervousness. The stock market overshoots in both directions, getting too enthusiastic about good news and too gloomy about bad news and uncertainty. Those overshoots, however, provide opportunities to both sell at elevated prices and buy at bargain prices. We are big fans of bargain prices.

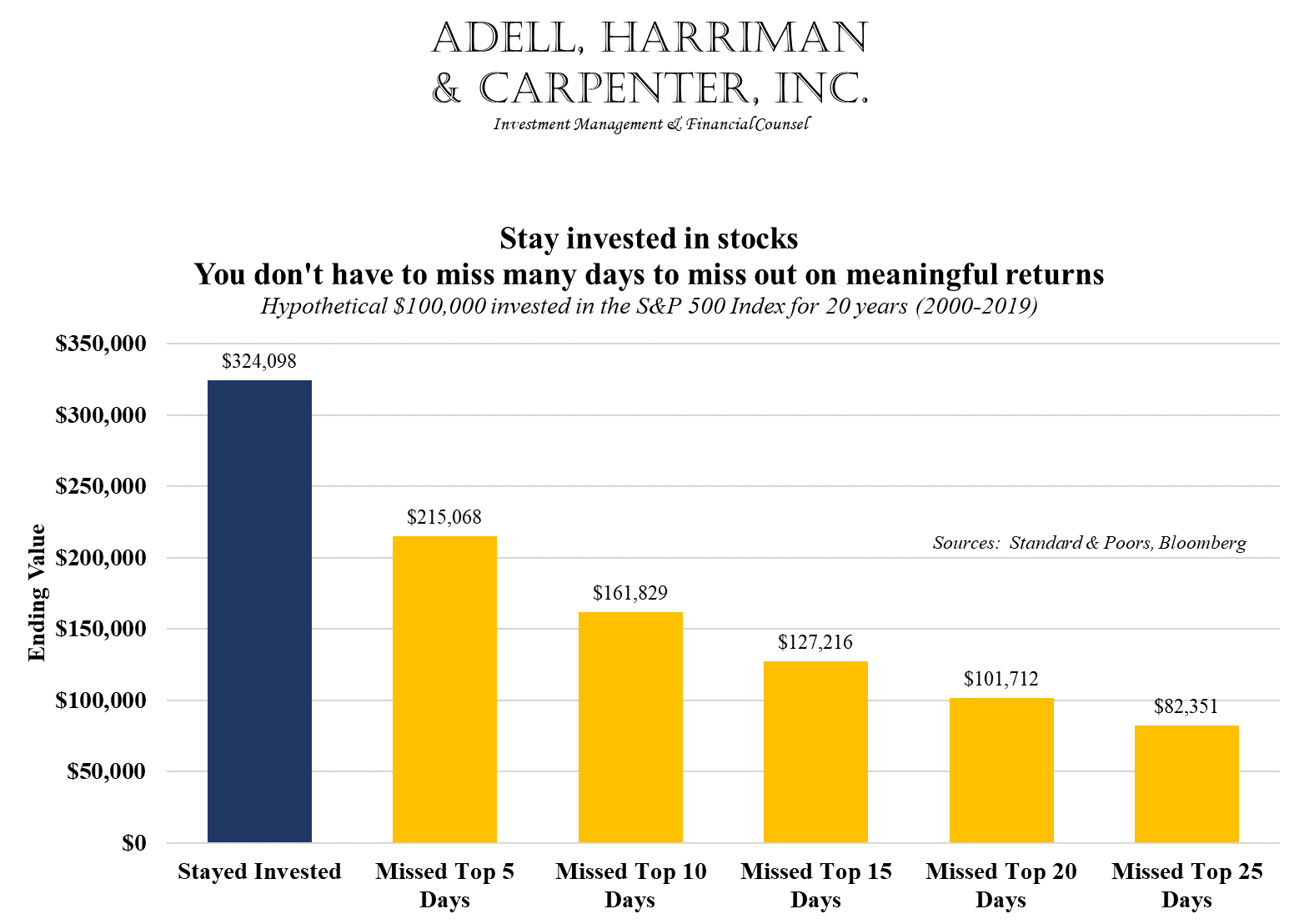

What should you do during those stretches when it seems like the market is falling every day? The short answer is “stay the course”. Knowing theses stretches are a regular and normal – if unpleasant – occurrence, we plan with clients to set up a cash reserve they can tap into for unanticipated spending needs. That cash could be in an FDIC-insured bank account or a money market fund, but it’s cash on hand available to spend on short notice. Additionally, we use a combination of interest income, dividend income and bond maturities to match actual cash flows with anticipated cash needs and regular account withdrawals. The unexpected can and will happen to all of us from time to time, but we go to great lengths to limit the potential need to sell investment holdings to raise cash in an unfavorable market environment. Let’s harvest cash when the trend has been our friend and set that cash aside for the proverbial rainy day. Once we’ve addressed potential and anticipated cash needs, our best piece of advice to long-term investors is to stay invested in stocks. As the accompanying graphic shows, staying invested pays off. Being out of the stock market for even short periods can dramatically impact long-term returns.

Even if the short-term trend is making you nervous, we’d point to history and suggest that in spite of normal and frequent pullbacks, the stock market’s long-term wealth creation trend will continue.