One Big Beautiful Bill

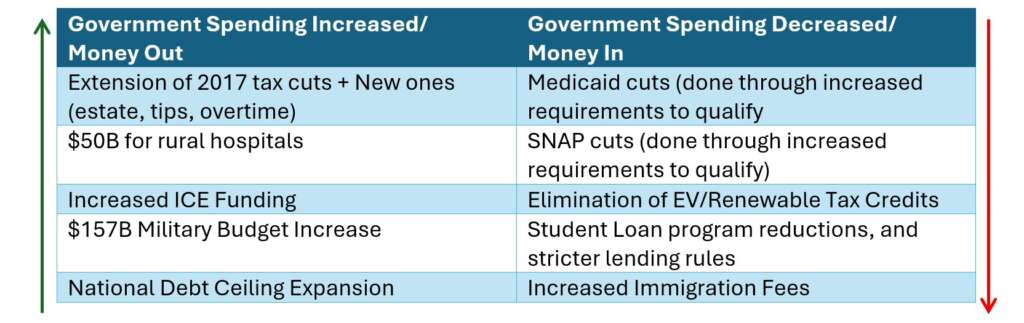

At the center of the Bill, signed on July 4th by President Trump, is a permanent extension of his tax cuts set in place in 2017 that were set to expire this year. Some of these include permanently lowered individual tax rates, which reduced the top individual rate from 39.6% to 37%. The standard deduction will remain at levels that significantly reduced the number of itemized tax filings, and the estate tax exemption was doubled under the 2017 law, and now permanently increased further.

New features of this bill build on those 2017 cuts: federal income tax for tips has been removed, and a new deduction for overtime pay has been introduced for individuals making less than $150,000 (with the deduction phasing out above that income). The child tax credit, which would have reverted to $1,000 if the bill was not passed, has been permanently extended to $2,200 per child. The cap on SALT (State and Local Tax) deductions has greatly increased from $10,000 to $40,000 for five years. While not fully fleshed out yet, the Bill aims to create “Trump Accounts,” that are tax-free and designed to build savings for newborns. A permanent increase in the unified credit and GSTT exemption threshold to $15 million per individual (or $30 million for married couples) allows high-net-worth families to avoid the 40% tax on wealth transfers to future generations.

Business Tax Provisions

Businesses will now be allowed to recognize and immediately deduct (expense) domestic R&D costs in the year they are incurred or capitalize and amortize costs over the useful life of the research. Previously, domestic R&D was required to be amortized over 5 years. This change is effective for tax years beginning after December 31, 2024, and allows for retroactive application to costs incurred from 2022-2024, enabling businesses to amend prior returns for refunds. The bill also adds 100% Qualified Production Property (QPP) Depreciation for 2030, which is for domestic manufacturing real estate, and incentivizes domestic production. Furthermore, the Section 179 expensing cap is increased to $2.5 million, enabling businesses to immediately deduct more of their equipment purchases.

Medicare, Medicaid, and Food Stamps (SNAP)

The Bill will result in approximately $1 trillion in cuts to Medicaid over the next decade, primarily done through new requirements for those enrolled. Individuals aged 19-64 would be required to work, go to school, or perform 80 hours of community service a month to stay enrolled. The Congressional Budget Office estimates 10.9 million fewer Americans on health insurance by 2034 and will effectively defund Planned Parenthood clinics by prohibiting them from accepting Medicaid funds for their services. There was a last-minute addition for rural hospitals, and $50 billion will be provided after some GOP senators expressed concerns about hospital closures. The SNAP program will also expand its working requirements, with work requirements extended to age 64 from 55. SNAP will also lose exemptions for groups such as the homeless, youth aging out of foster care, and veterans. Student Loans will also be greatly impacted, including more restrictions on borrowing, fewer and less flexible repayment options, and a greater emphasis on financial accountability from both colleges and borrowers. Specifically, Grad PLUS loans are eliminated, Parent PLUS loans are capped, and most existing income-driven repayment plans are consolidated into a less flexible option with longer forgiveness timelines.

Border Security and Military

The Bill aims to increase funding for ICE from $10 billion now to $100 billion by 2029, as well as the provision of $60 billion in supplemental funding for US Customs and Border Protection (CBP). The Bill contains a $46.5 billion provision for the construction, maintenance, or improvement of physical barriers and related system attributes along the northern and southern borders. The Bill introduces a $100 annual fee for asylum applications, $550 for employment authorization for asylum seekers, and a $500 fee for Temporary Protected Status (TPS). Expedited removal has been expanded, allowing for “fast track” deportation for certain groups, including noncitizens found inadmissible on criminal or national security grounds. The bill also contains a $157 billion funding increase to the American military/defense allocated for: shipbuilding, munitions, quality of life for military personnel, and specific funding for a “Golden Dome” missile defense system.

Energy Policy

As of September 30th, 2025, the $7,500 federal tax credits for new electric vehicles, and $4,000 tax credits for used EVs are terminated. Instead, American taxpayers will be able to deduct interest paid on auto loans for American-made cars. Tax credits for wind and solar energy projects, and energy-efficient home improvements are either ended completely or made much more difficult to qualify for. Many will terminate by the end of 2025 or mid-2026. The Bill aims to promote the production of oil, gas, and coal. Fossil fuel lease sales in many restricted areas, including the Arctic National Wildlife Refuge, have been reinstated. Royalty rates for drilling and mining on federal land have been reduced, and mandatory timber sales have been established. These changes are expected to increase average annual electricity costs by more than $100 per household.

Debt Ceiling

All the previous sections of the Bill are made possible through a raise of the National Debt Ceiling by $5 trillion. The Congressional Budget Office estimates the bill will add between $2.8- $3.4 trillion to the national debt by 2034 and could reach $5 trillion over the next decade.